Senior title loans offer a fast and flexible financial solution for older adults in Fort Worth and Dallas with unexpected expenses, less-than-perfect credit, and limited mobility. These secured loans, assessed based on vehicle value, provide customizable repayment terms through online platforms, ensuring informed decision-making for seniors' short-term financial needs.

“Explore the world of flexible financial solutions with Title Loans for Seniors online. This comprehensive guide delves into the benefits and intricacies of senior-focused title loan options. We break down ‘Understanding Senior Title Loans’ and highlight the advantages of customizable repayment plans tailored to seniors’ needs. Additionally, we navigate the secure process of applying for these loans through online platforms, ensuring a streamlined experience. Discover how this approach offers both accessibility and peace of mind for those considering short-term funding.”

- Understanding Senior Title Loans: A Comprehensive Guide

- The Benefits of Flexible Repayment Options for Seniors

- Navigating Online Platforms: Secure Senior Loan Applications

Understanding Senior Title Loans: A Comprehensive Guide

Senior Title Loans offer a unique financial solution tailored to the needs of older individuals who may require emergency funding. These loans are secured by an asset, typically a vehicle owned by the borrower, which means they can provide access to capital with potentially faster loan approval compared to traditional bank loans. This type of lending is especially attractive for seniors who might not have excellent credit but still need liquidity for unforeseen expenses or unexpected financial emergencies.

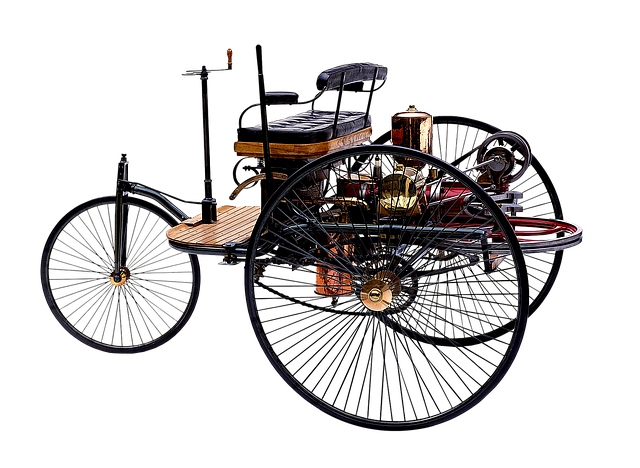

Understanding how these loans work is essential. The process usually involves assessing the value of the borrower’s vehicle, which determines the loan amount. Unlike truck title loans, where only commercial vehicles are considered, senior title loans can include personal vehicles like cars, SUVs, or even motorhomes. Repayment terms are flexible, allowing seniors to make payments over a more extended period, reducing the financial burden during retirement years. This comprehensive guide aims to demystify the process, ensuring that seniors make informed decisions regarding their financial well-being and explore alternatives for emergency funding.

The Benefits of Flexible Repayment Options for Seniors

For seniors looking for financial support, flexible repayment options on title loans can offer a much-needed lifeline. This unique aspect of these loans allows borrowers to tailor their repayments to fit their specific budget and needs, providing them with greater control over their finances. Instead of adhering to strict monthly payments, seniors can choose plans that spread out the cost over a longer period, making it easier to manage during retirement or times of reduced income.

This flexibility is especially beneficial in cities like Fort Worth and Dallas, where living expenses can be high. With Dallas Title Loans and Fort Worth Loans offering customizable terms, seniors can access fast cash without the usual constraints. This approach ensures they don’t have to rush to meet repayment deadlines, allowing for a more sustainable financial journey.

Navigating Online Platforms: Secure Senior Loan Applications

Navigating online platforms has become an integral part of modern life, especially for seniors who seek convenient and accessible financial solutions. When it comes to applying for a loan, many older adults turn to Title Loans for Seniors as a viable option. The internet offers a secure and efficient way to apply for these loans without the need for extensive paperwork or in-person visits. Online platforms streamline the entire process, making it particularly appealing to seniors who may have limited mobility.

In Fort Worth and beyond, many lending institutions now provide digital tools that simplify the Title Loan Process. These platforms ensure a safe and secure application experience by employing advanced encryption technology to safeguard personal information. Seniors can conveniently apply from the comfort of their homes, filling out digital forms and providing necessary documentation electronically. This modern approach not only saves time but also helps seniors gain access to fast cash when they need it most.

Senior title loans offer a flexible and accessible solution for older individuals seeking financial support. By providing a secure borrowing option with the added benefit of flexible repayment plans, these online services can help seniors navigate their financial needs comfortably. When choosing an online platform, it’s crucial to prioritize security and transparency. Understanding your loan terms and picking a reputable lender ensures a positive experience, empowering seniors to access the funds they need without unnecessary stress.