Title loans for seniors provide quick financial support using car titles as collateral, bypassing strict credit requirements. Lenders in San Antonio assess vehicle value, age, condition, and liens to determine loan amounts. Seniors can maximize borrowing by assessing vehicle equity, understanding lender terms, and maintaining financial stability through emergency funding.

Title loans for seniors offer a quick financial solution, allowing them to access cash using their vehicle’s title as collateral. This article explores maximum loan amounts available within this unique lending option, catering specifically to the needs of older borrowers. We’ll delve into the factors that determine these limits and provide valuable tips to help seniors maximize their loan potential while ensuring they make informed decisions.

- Understanding Title Loans for Seniors

- Factors Influencing Maximum Loan Amounts

- Maximizing Loan Potential: Tips for Seniors

Understanding Title Loans for Seniors

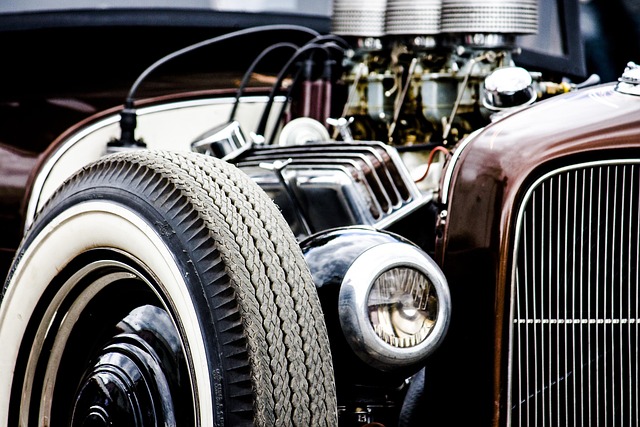

Title loans for seniors have gained popularity as a quick source of cash for those aged 62 and above. This lending option is unique because it uses an individual’s car title as collateral, allowing them to access a loan even if their credit history isn’t perfect. The process involves a simple application, where the lender conducts a brief Vehicle Inspection to assess the vehicle’s value and establishes loan terms, including Interest Rates, based on the available equity.

Senior citizens often find themselves in situations where they need immediate financial assistance for various reasons, such as medical emergencies or unexpected life events. Title loans offer a straightforward path to Loan Eligibility without the stringent requirements typically associated with traditional bank loans. This alternative financing method is particularly attractive to seniors who may have limited credit options due to their age or previous credit issues.

Factors Influencing Maximum Loan Amounts

When it comes to Title Loans for Seniors, several factors play a crucial role in determining the maximum loan amount available. Lenders carefully assess each borrower’s financial situation, including their vehicle’s value and age, to ensure a secure and reasonable loan offer. The primary objective is to provide seniors with a much-needed financial solution while maintaining a low risk for the lender.

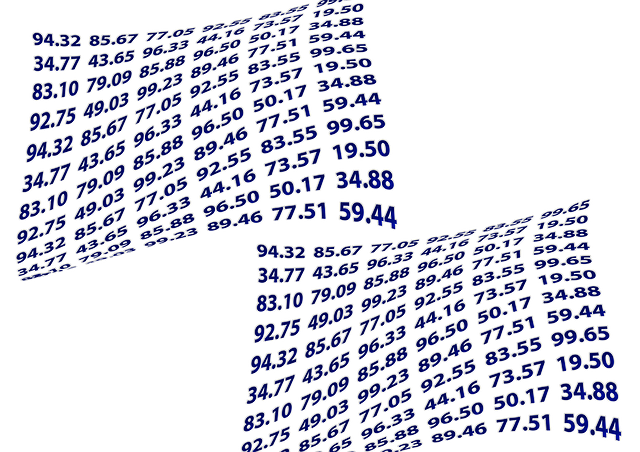

In San Antonio Loans, for instance, lenders often consider the market value of the senior’s car, its overall condition, and any existing liens. Additionally, age can impact the maximum amount since older vehicles typically have lower resale values. Loan Extension options may be available for borrowers who need more time to repay, but these could affect future borrowing potential. Therefore, understanding these factors is essential for seniors seeking a suitable Title Loan as a temporary financial solution.

Maximizing Loan Potential: Tips for Seniors

When considering title loans for seniors, maximizing the loan amount available is a key strategic move. The first step in this process involves assessing your asset’s value, especially if you own a vehicle. Title loans are secured by the vehicle’s title, so having a clear title and a vehicle with substantial equity can significantly boost your borrowing potential. Seniors should also meticulously review the title loan process to understand the terms, interest rates, and repayment conditions offered by different lenders.

To enhance their loan prospects, seniors can work on improving their credit scores if they are below par. While not always a requirement for title loans, a higher credit score can lead to better interest rates and more favorable loan terms. Additionally, emergency funding should be considered as part of the financial planning process alongside title loans. This could involve cutting unnecessary expenses or exploring other sources of income to ensure you have a safety net during unexpected events.

Title loans for seniors offer a unique opportunity to access immediate financial support. By understanding how maximum loan amounts are determined and leveraging certain strategies, older adults can maximize their loan potential. Factors like credit history, vehicle value, and state regulations play a crucial role in setting these limits, so it’s essential to be informed. With the right approach, seniors can navigate this process confidently, ensuring they receive the most favorable terms possible for their title loans.