Title loans for seniors provide quick cash using vehicles as collateral, appealing to those with limited credit options. The process is online and accessible but carries high-interest rates and risks. Refinancing can offer lower rates and flexible terms, but seniors must carefully consider lender requirements and fees. Researching lenders like Fort Worth Loans and understanding approval criteria is crucial for favorable refinancing terms.

Many seniors consider title loans as a financial option, but can they refinance existing balances? This article explores the possibilities and nuances surrounding this question. We delve into the specifics of title loans tailored for seniors, examine eligibility criteria for refinancing, and highlight the benefits and considerations involved in managing and potentially lowering existing loan balances. Understanding these factors is crucial for making informed decisions about your financial future.

- Understanding Title Loans for Seniors

- Eligibility Criteria for Refinancing

- Benefits and Considerations of Refinancing Balances

Understanding Title Loans for Seniors

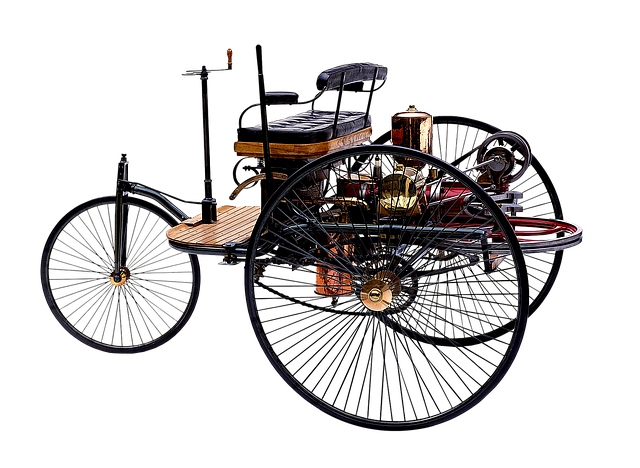

Title loans for seniors are a financial option designed to provide quick access to cash using their vehicle as collateral. These loans are particularly attractive to older adults who may have limited credit options or need immediate funding for various reasons, such as medical emergencies, home repairs, or unexpected expenses. The process typically involves assessing the vehicle’s valuation and offering a short-term loan based on its value.

Senior borrowers can utilize online applications to conveniently apply for title loans without the need for extensive documentation. This accessibility is especially beneficial for those with mobility issues or limited access to traditional banking services. While title loans can be a lifeline in desperate situations, it’s crucial for seniors to weigh the potential risks and high-interest rates before pledging their vehicle as collateral.

Eligibility Criteria for Refinancing

When considering refinancing an existing title loan balance, seniors should be aware that specific eligibility criteria apply. Lenders typically require borrowers to meet certain age and income requirements, ensuring they can handle the repayment obligations. The minimum age varies among lenders, but many offer refinancing options for individuals aged 50 and above.

Additionally, a stable source of income is essential. For seniors on fixed pensions or social security, providing proof of these income streams may be necessary. Lenders assess the borrower’s ability to repay the loan through various repayment options, including monthly installments or lines of credit with direct deposit. Fast cash refinancing can be attractive, but it’s crucial to understand the terms and conditions to avoid falling into a cycle of high-interest debt.

Benefits and Considerations of Refinancing Balances

Refinancing existing title loan balances can offer several benefits for seniors looking to manage their debt more effectively. One of the key advantages is the potential for lower interest rates, which can significantly reduce the overall cost of borrowing over time. This is especially beneficial for seniors who may have struggled with unexpected medical bills or other financial obligations, allowing them to extend the lifespan of their loan and avoid default. Additionally, refinancing provides an opportunity to explore more favorable repayment options tailored to the senior’s income and expenses, such as extending the loan term or negotiating a payment plan that aligns better with their budget.

When considering refinancing, it’s crucial to weigh these advantages against potential drawbacks. Lenders may have different requirements and fees associated with refinancing, so seniors should thoroughly research and compare offers from various lenders. Furthermore, ensuring transparency in terms and conditions is essential to avoid hidden costs or penalties. Fort Worth Loans, for instance, can offer a range of repayment options, but it’s important to assess the overall value and long-term implications before making a decision. Loan approval processes may also vary, so seniors should be prepared to meet specific criteria to secure favorable refinancing terms.

Seniors considering their financial options can explore refinancing existing title loan balances as a viable strategy. By understanding the eligibility criteria and weighing the benefits against potential considerations, individuals in this demographic can make informed decisions tailored to their unique circumstances. Title loans for seniors offer a path to access immediate funds, but refinancing provides an opportunity to potentially reduce interest rates and extend repayment terms, ensuring a more manageable financial burden.