Title loans can provide quick cash for seniors with limited assets, but they carry significant risks including high-interest rates, short repayment periods, and potential foreclosure. Alternatives like debt consolidation, community support, and non-lending sales of vehicle equity offer safer options to protect seniors' financial health and independence.

Title loans have emerged as a seemingly attractive option for senior citizens facing financial strain. However, these short-term, high-interest loans come with significant risks. This article delves into the allure and perils of title loans for seniors, exploring financial dangers like excessive interest rates, potential loss of assets, and long-term debt cycles. We also present alternative solutions and safeguards, emphasizing the importance of considering safer funding options tailored to the unique needs of senior citizens.

- Understanding Title Loans and Their Attractiveness to Seniors

- Financial Risks and Potential Consequences for Elderly Borrowers

- Alternative Solutions and Safeguards for Senior Citizens in Need of Funds

Understanding Title Loans and Their Attractiveness to Seniors

Title loans have emerged as a financial option that caters specifically to seniors’ needs, especially those with limited assets and income. These loans use a senior’s home equity as collateral, offering a quick and accessible way to secure funding. The appeal lies in their simplicity; there are typically no credit checks or extensive loan requirements, making them an attractive alternative to traditional banking options for folks with bad credit or a less-than-perfect financial history. This type of loan can provide seniors with the necessary funds for emergencies, medical bills, or even home improvements.

By tapping into their home equity, title loans for seniors offer a way to gain immediate access to capital without the rigorous processes often associated with bank loans. While this convenience is appealing, it’s crucial to understand that these loans are secured against property, meaning non-payment could result in foreclosure. Therefore, borrowers must carefully consider their financial situation and ensure they can comfortably manage the loan payoff to avoid potential loss of their homes.

Financial Risks and Potential Consequences for Elderly Borrowers

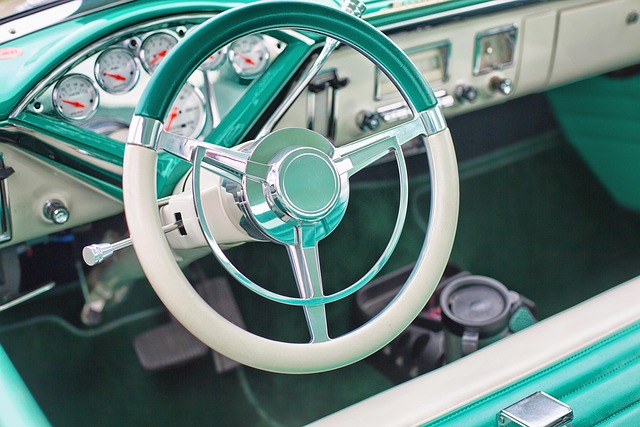

Taking out a title loan can be appealing for seniors looking for quick cash, but it comes with significant financial risks. These loans, secured by a senior’s vehicle title, often have high-interest rates and short repayment periods, making them difficult to repay. Many elderly borrowers may struggle to meet these demands, leading to a cycle of debt. If they fail to make payments on time, they risk losing their vehicles, which could limit their mobility and independence.

Furthermore, title loans for seniors can impact their overall financial health. Defaulting on such loans might result in additional fees and penalties, increasing the borrower’s financial burden. In some cases, it may even lead to foreclosure proceedings, leaving seniors vulnerable and potentially forcing them to make tough decisions regarding their living arrangements. It’s crucial for seniors considering this option to understand these potential consequences and explore alternative solutions like debt consolidation or semi-truck loans, especially if they have stable income through direct deposit, which could offer more favorable terms.

Alternative Solutions and Safeguards for Senior Citizens in Need of Funds

Senior citizens facing financial emergencies have options beyond title loans. Exploring alternative solutions can provide a safer and more secure path to accessing funds. One such option is leveraging their vehicle equity through non-lending, private sale or trading in their vehicles for cash. This approach bypasses the high-interest rates and potential pitfalls of title loans, offering a lower-risk way to secure temporary financing.

Additionally, senior citizens can seek support from community organizations, government assistance programs, and family members. Many charities and non-profits cater specifically to seniors in need, providing grants or financial aid without the burden of debt. A simple conversation with trusted loved ones might also reveal unforeseen resources or opportunities for part-time work. Before considering a title loan, exploring these alternatives can empower senior citizens to make informed decisions that protect their assets and overall financial well-being.

While title loans for seniors may seem like a quick solution, it’s crucial to weigh the significant financial risks involved. The high-interest rates and potential loss of asset value can have severe consequences for elderly borrowers. Before considering this option, exploring alternative solutions like government assistance programs, community resources, or consulting with financial advisors is essential. These safeguards can provide much-needed support without putting seniors’ hard-earned assets in jeopardy.