Title loans for seniors aged 62+ offer quick cash access using vehicle titles as collateral, bypassing credit checks. Popular in Dallas, they aid retirees with unexpected expenses, providing discretion and an alternative to conventional loans. However, these loans have high-interest rates and less flexible terms, making long-term debt management challenging. Seniors should carefully consider their financial goals before opting for title loans.

Many seniors without regular employment may find themselves in need of quick financial support. Title loans could offer a viable solution, providing a safety net during times of need. This article explores title loans as an alternative financing option specifically tailored for seniors, delving into how these loans work, eligibility requirements, and the potential advantages and drawbacks. Understanding these factors is crucial for making informed decisions regarding senior financial well-being.

- Understanding Title Loans: An Option for Seniors

- Eligibility Criteria: Accessing Loan Opportunities

- Benefits and Considerations: A Financial Safety Net

Understanding Title Loans: An Option for Seniors

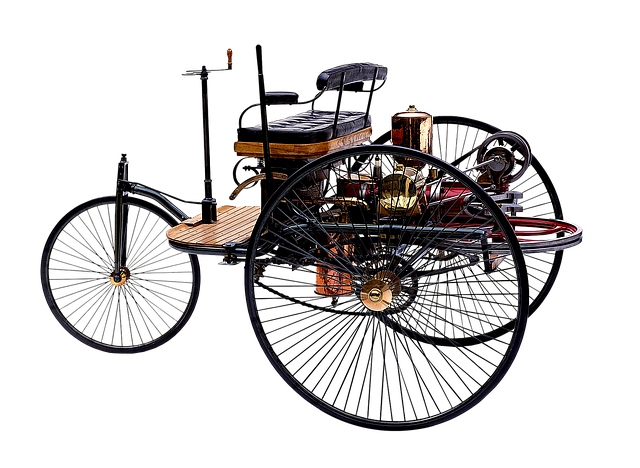

Title loans for seniors offer a unique financial solution for individuals aged 62 and above who may be facing cash flow issues despite not having traditional employment. This alternative lending option allows seniors to borrow money by using their vehicle’s title as collateral. The process is relatively straightforward, involving less stringent credit checks compared to bank loans, making it accessible to those with limited or poor credit history.

Unlike other loan types, title loans for seniors do not require a lengthy application process or extensive documentation. Lenders primarily focus on the value of the borrower’s vehicle and its clear title rather than their employment status or income. This makes it an attractive option for retirees or part-time workers who still own their vehicles but may struggle to meet regular repayment obligations due to fixed expenses or reduced incomes. With a simple loan approval process and the security of vehicle collateral, seniors can access much-needed funds quickly.

Eligibility Criteria: Accessing Loan Opportunities

Accessing title loans for seniors is a viable financial solution for those aged 62 and above who lack stable employment but own a vehicle. The primary eligibility criteria involve proving ownership of the vehicle through clear vehicle titles and maintaining a minimum level of income, often from retirement benefits or other fixed sources. These loans are unique because they use the equity in one’s vehicle as collateral, allowing seniors to gain access to immediate funds without the strict credit checks typically associated with traditional loans.

In Dallas, title loans have gained popularity among senior citizens as a means to cover unforeseen expenses or bridge financial gaps. The process is straightforward; borrowers visit a lender, provide their vehicle title, and receive funding based on their vehicle’s equity value. Unlike other loan types, these do not require regular employment verification, making them an attractive option for seniors who may have retired or face income instability. Dallas title loans, in particular, offer a secure and discreet way to access financial resources without the red tape often associated with conventional borrowing methods.

Benefits and Considerations: A Financial Safety Net

Title loans for seniors without regular employment can serve as a financial safety net, offering a quick and accessible solution to short-term cash needs. These loans, secured against the senior’s vehicle title, provide a straightforward alternative to traditional banking options that may be less available or appealing to those without steady employment. The benefits are significant: fast cash in hand, potential debt consolidation, and an opportunity to maintain vehicle ownership, crucial for mobility and independence.

Considerations, however, are equally vital. Unlike semi truck loans or other forms of financing, title loans typically come with higher-than-average interest rates, making them a more expensive choice in the long run. Additionally, the loan process can be simpler but also less flexible compared to other credit options, as it relies on the collateral of the vehicle. Seniors should weigh these factors carefully, especially when considering whether a title loan aligns with their financial goals and overall debt management strategy.

Title loans can serve as a viable financial option for seniors without regular employment, offering a quick and accessible solution. By understanding the eligibility criteria and weighing both benefits and considerations, seniors can make informed decisions about their economic future. This alternative financing method allows them to tap into the equity of their assets, providing a safety net during challenging times. However, it’s crucial to approach title loans with caution, ensuring they align with individual financial goals and long-term stability.