Title loans for seniors offer an accessible financial solution with fast approval, using vehicle equity as collateral instead of credit history. Ideal for emergencies and unexpected expenses, they provide short-term funding with competitive rates but carry repossession risk if defaulted. Understanding terms is crucial to avoid financial strain.

“Title loans for seniors with low credit or no score offer a unique financial solution in their golden years. As traditional loan options may be inaccessible, understanding title loans can provide relief during challenging economic times. This article guides you through the process, exploring qualifications, benefits, and potential drawbacks. Learn how senior borrowers can access much-needed funds, maintain asset security, and navigate this alternative lending route effectively.”

- Understanding Title Loans: An Option for Seniors

- Qualifications and Requirements for Senior Borrowers

- Benefits and Potential Drawbacks Explained

Understanding Title Loans: An Option for Seniors

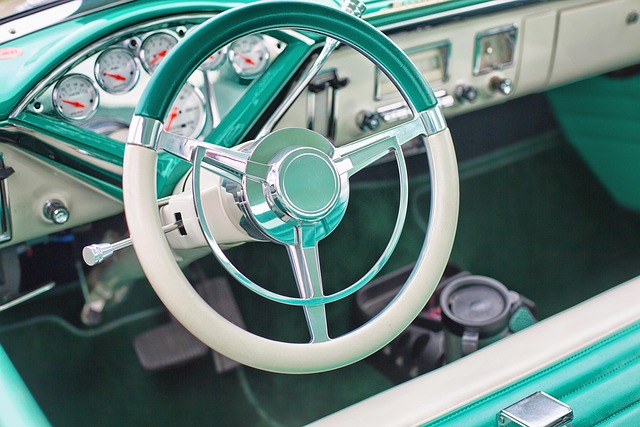

Title loans for seniors have emerged as a viable financial option, especially for those with limited credit history or low credit scores. These loans are secured against an asset, typically the senior’s vehicle, offering a unique advantage in terms of loan eligibility despite poor credit. Unlike traditional bank loans that often require a detailed credit check, title loans focus on the value and ownership of the collateral rather than the borrower’s financial past.

For seniors looking for quick cash or to fund unexpected expenses, this alternative financing method can be beneficial. It provides access to funds without the stringent requirements of a conventional loan. Whether it’s for medical bills, home repairs, or even a semi-truck loan for those in trucking industries, understanding title loans can offer peace of mind and financial flexibility when traditional lending avenues seem out of reach.

Qualifications and Requirements for Senior Borrowers

When it comes to qualifying for a loan, senior borrowers often face unique challenges due to age and potentially lower credit scores. However, title loans for seniors offer a viable financial solution in such cases. These loans are designed to provide access to capital based on the value of an individual’s property, primarily their vehicle. Unlike traditional loans that heavily rely on credit history, title loans focus more on the equity held in the asset, making them accessible even to those with no credit or low credit scores.

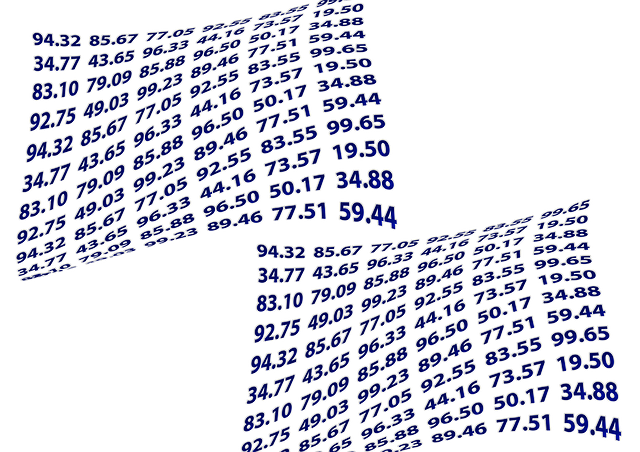

The qualifications for a senior borrower typically involve owning a vehicle free and clear, meaning there are no outstanding loans or leases on it. Lenders will then assess the value of the vehicle to determine the maximum loan amount. Interest rates for title loans tend to be competitive, and loan terms can vary depending on the borrower’s preference and repayment ability. This flexibility ensures seniors have options tailored to their specific financial needs.

Benefits and Potential Drawbacks Explained

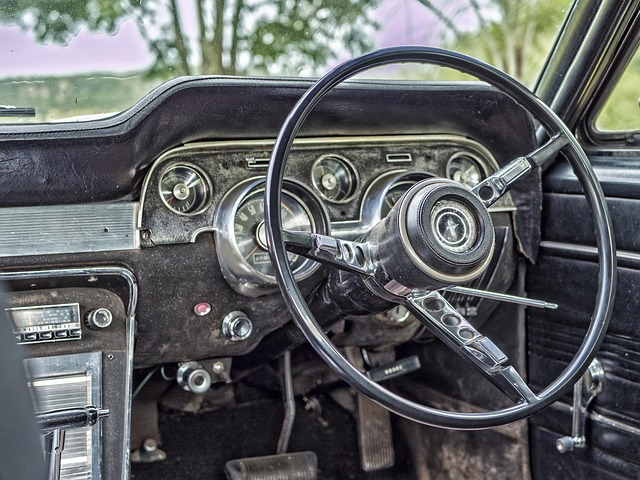

For seniors with limited credit history or low scores, title loans can offer a unique opportunity to access emergency funding. These short-term, secured loans use a senior’s vehicle title as collateral, providing an alternative for those who may struggle to qualify for traditional bank loans due to poor credit. The benefits are clear: quick approval, often without the stringent credit checks that accompany other loan types. This makes them an attractive option for seniors needing cash fast.

However, it’s crucial to consider potential drawbacks. Since these loans are secured by a vehicle title, there is a risk of repossession if the borrower defaults. Additionally, interest rates can be significantly higher than those offered on conventional loans, adding up quickly over time. A thorough understanding of the terms and conditions, including the loan duration, interest calculation, and potential fees, is essential before taking out a title loan to avoid financial strain in the future.

Title loans can provide a viable financial solution for seniors with low credit or no credit score, offering a quick and accessible way to access capital. However, it’s crucial to weigh the benefits against potential drawbacks, such as high-interest rates and the risk of default impacting future assets. Understanding the qualifications and requirements is essential before pursuing this option, ensuring it aligns with individual financial needs and goals.