Title loans for seniors provide a short-term solution, allowing them to borrow against their vehicle's title without a credit check, keeping possession during the loan period and offering extensions for missed payments. Open communication with lenders is key to avoid transfer in case of delays. This method offers quick funding for daily transportation-dependent seniors, maintaining financial control through responsible borrowing practices.

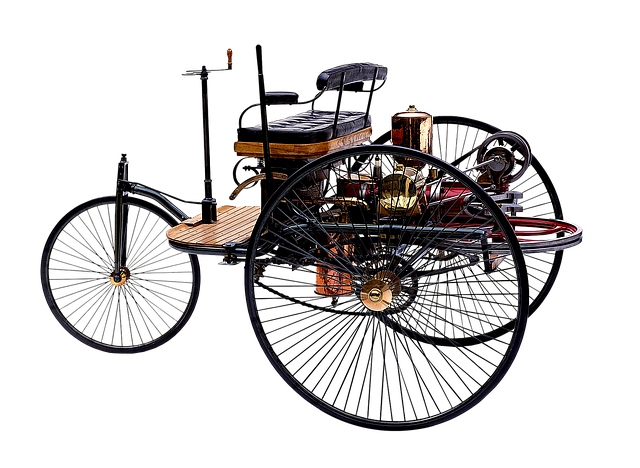

Many seniors own vehicles, but navigating financial options can be challenging. Title loans offer a unique solution, providing access to capital secured by a vehicle’s title. This comprehensive guide explores title loans as an option specifically tailored to senior citizens, delving into how joint vehicle ownership can impact eligibility and highlighting the benefits and considerations of this alternative financing method.

- Understanding Title Loans: A Comprehensive Guide for Seniors

- Joint Vehicle Ownership: Navigating Title Loan Requirements

- Benefits and Considerations: Senior Title Loans in Focus

Understanding Title Loans: A Comprehensive Guide for Seniors

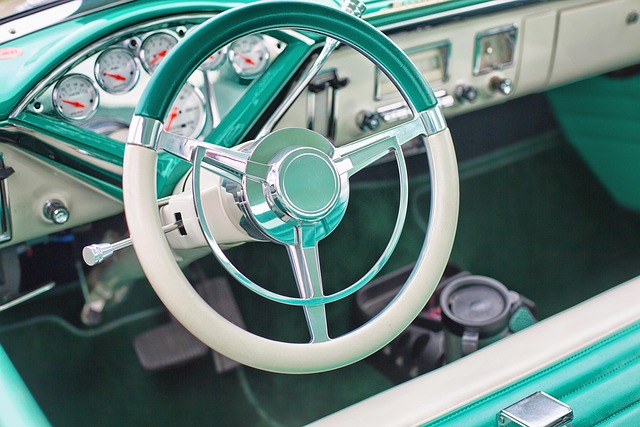

Title loans for seniors can be a viable financial option when facing short-term cash flow issues. This type of loan is secured by an asset—in this case, the senior’s vehicle—and allows them to borrow money using their car’s title as collateral. Unlike traditional loans, these do not require a credit check, making them attractive for those with lower credit scores or no credit history. The process involves applying for the loan, providing proof of ownership, and setting up a repayment plan. Once approved, the lender will transfer funds directly to the borrower, and they retain possession of their vehicle throughout the loan period.

In Fort Worth Loans, understanding the terms is crucial. Loan extensions may be available if the senior cannot make payments on time, allowing them to catch up without forfeiting ownership. However, it’s essential to communicate openly with the lender about any potential delays as failing to meet repayment deadlines can result in the title transfer to the lender. This alternative solution offers seniors a chance to access much-needed funds while maintaining some financial flexibility through responsible borrowing and management.

Joint Vehicle Ownership: Navigating Title Loan Requirements

When it comes to joint vehicle ownership, navigating title loan requirements can be a unique challenge for seniors. In many cases, both owners need to agree on borrowing against the asset, and each must meet the lender’s eligibility criteria. This often involves providing proof of income, identity, and residency. Fortunately, title pawn options offer a solution that keeps the process accessible for seniors who may face restrictions in traditional loan scenarios.

One significant advantage of title loans for seniors with joint ownership is the ability to maintain control over their vehicle while securing quick funding. Unlike some other types of loans, keeping your vehicle is a key feature of these loans. This flexibility allows seniors to access needed funds without sacrificing their primary mode of transportation, making it an attractive option for those who rely heavily on their vehicles for daily activities.

Benefits and Considerations: Senior Title Loans in Focus

Senior citizens often face unique financial challenges, especially when it comes to liquidating assets for quick cash. Title loans for seniors with joint vehicle ownership can serve as a viable solution, offering several benefits tailored to their needs. One of the primary advantages is the use of a senior’s vehicle as collateral, which allows them to keep their beloved transportation while accessing much-needed funds. This aspect is particularly appealing to those who rely on their vehicles for daily activities and social interactions.

When considering title loans, seniors should be mindful of the interest rates associated with these short-term lending options. While it provides access to immediate capital, the interest rates can vary widely among lenders. It’s crucial to compare offers from different financial institutions to secure the most favorable terms. Additionally, keeping their vehicle as collateral ensures that they maintain some level of independence and mobility during this process.

Title loans for seniors with joint vehicle ownership can offer a flexible financial solution during retirement. By understanding the comprehensive guide and navigating the specific requirements of joint ownership, seniors can leverage their vehicle’s equity for short-term financial needs. While there are benefits, it’s crucial to consider interest rates, repayment terms, and potential impacts on future plans. In conclusion, senior title loans can provide a game-changer for those looking to access immediate funds while retaining vehicle ownership.